Did you know that simple tax mistakes can lead to hefty fines or even business closure? ![]()

Don’t let these common BIR violations put your hard-earned money and business at risk!

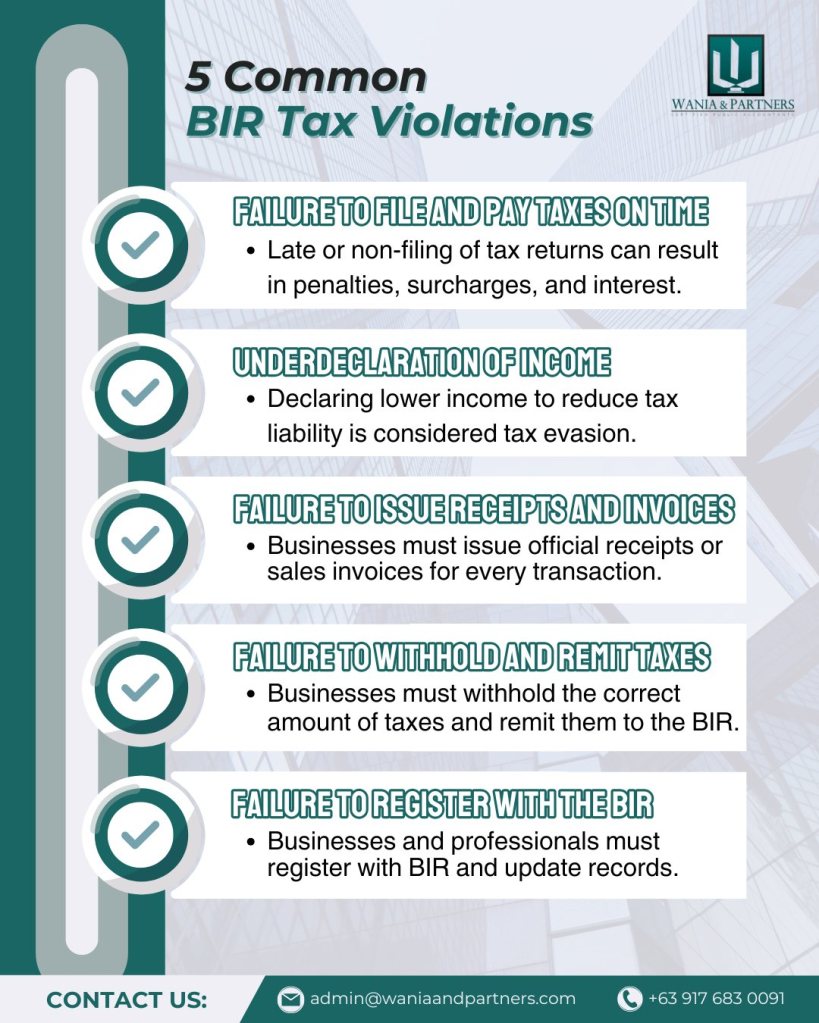

Here are 5 BIR tax violations you should AVOID at all costs:

![]() Late or non-filing of tax returns

Late or non-filing of tax returns

![]() Underdeclaring income (Yes, that’s tax evasion!)

Underdeclaring income (Yes, that’s tax evasion!)

![]() Not issuing official receipts or invoices

Not issuing official receipts or invoices

![]() Failing to withhold and remit taxes

Failing to withhold and remit taxes

![]() Operating without proper BIR registration

Operating without proper BIR registration

Stressed about tax compliance?

![]()

![]() We can help keep your finances in order and your business BIR-compliant.

We can help keep your finances in order and your business BIR-compliant.

![]() Message us for hassle-free accounting and tax services!

Message us for hassle-free accounting and tax services!